Earning interest in cryptocurrency is super attractive to investors who prefer long-term investing and believe the prices will grow in the future.

Even if you avoid risk, you still can earn high yields on stablecoins: digital assets pegged to the U.S. dollar. If you already hold cryptocurrency and want to keep it for an extended period, then earning interest on your investments can help you to increase your savings.

To help you make extra income, let's learn more about crypto wallets that earn interest.

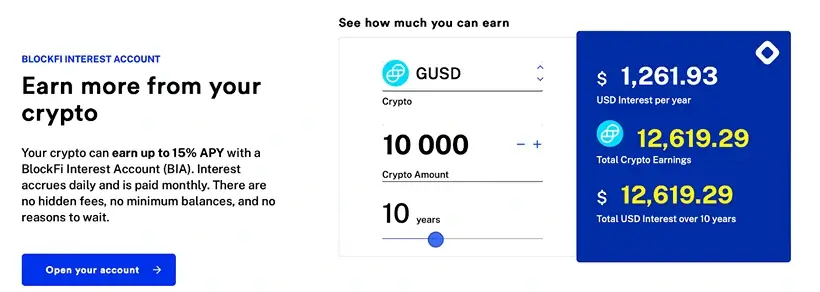

BlockFi Wallet

Advantages:

- Crypto investors can earn interest

- Users can take out crypto-backed loans

- Investors can buy or sell crypto directly within the app

Disadvantages:

- U.S. customers can't access interest-bearing accounts

- It only supports several coins

BlockFi is a top-rated but relatively new financial service provider in crypto. This platform allows accessing crypto loans and enables users to store cryptocurrencies on its platform. Compared with AQRU, BlockFi offers 15 crypto assets in its interest accounts. BlockFi only contributes 7.5% APY for its interest accounts. BlockFi users can borrow up to 50% of their crypto collateral.

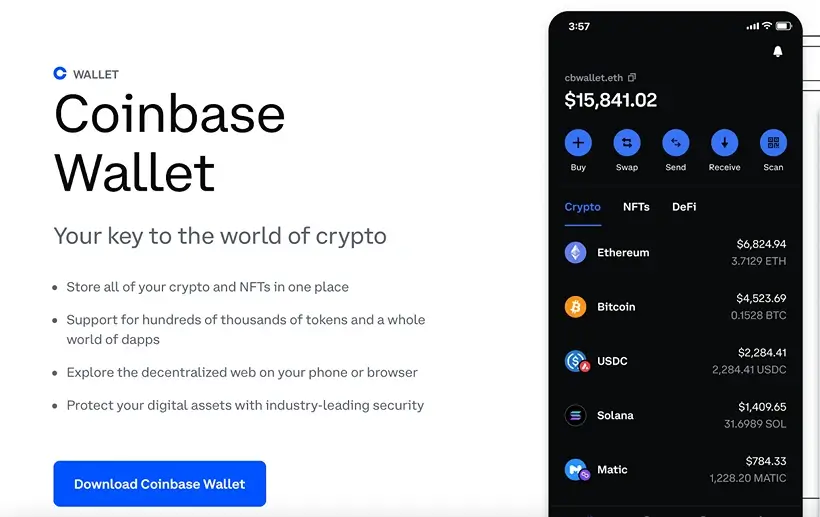

Coinbase App Wallet - A Non-Custodial Multicurrency Wallet

Advantages:

- Super user-friendly interface

- Supports over 500 crypto assets

- Only charges network fees

- Provides multi-signature and 2-factor authentication support

- Optional cloud backups

Disadvantages:

- Code is not open-source

- No support for Bitcoin

- Coinbase has a history of insufficient customer support

Source: Coinbase.com

Coinbase is a simple hot wallet ideal for beginners. It is easy to use, supports many tokens, and belongs to the popular Coinbase exchange. It enables users to securely store 44,000+ digital assets, interact with decentralized applications and buy and sell NFTs.

The highest APY is offered on Cosmos at 5%, with Ethereum yielding 4%. Tezos and Algorand pay 4.64% and 4%, respectively, while with Dai and USDC, this stands at just 2% and 0.15%. To be eligible for staking at Coinbase, you must have a verified account with a confirmed tax identification number (TIN).

Coinbase wallet is also non-custodial, which means that you can keep control over your private keys.

Ellipal Titan Crypto Wallet

Advantages:

- You can control your private keys and backup passphrase

- Supports 46 blockchains and thousands of tokens

Disadvantages:

- Unknown for many users

- Limited customer support

Source: Ellipal.com

Ellipal is less known than Ledger, but it is an excellent alternative. This intricate cold storage solution supports buying and staking crypto via dApps connections. You can stake popular cryptos and buy or swap Bitcoin via the Ellipal Titan wallet.

This wallet allows you to convert your coins to any supported currency without transferring them to an online exchange.

Crypto.com Wallet

Advantages:

- Supports over 90 cryptocurrencies

- You can use a Visa card to spend your crypto and earn rewards

- You can make interest on crypto holdings at a higher rate than the best high-yield savings accounts

Disadvantages:

- Not accessible to educational materials

- Higher trading fees for low-volume traders

- In-app live support can be pretty slow

Source: Crypto.com

Crypto.com wallet is another great option, which has various decentralized finance tools, an excellent onboarding process, and high security.

Defi wallets such as Crypto.com wallet give users full control over their digital assets and private key. But this also makes them responsible for keeping it secure.

As with other exchanges that feature both a custodial and a noncustodial wallet, it's important to distinguish between them. You can download the Crypto.com DeFi Wallet and use it for day-to-day crypto activities without making an account on Crypto.com's exchange.

With Crypto.com's Earn program, you can make up to 14.5% per year on your deposits of more than 30 cryptocurrencies. The interest is paid weekly. It all depends on the cryptocurrency you select to loan out, and the amount of CRO you hold in your account.

Exodus Crypto Wallet

Advantages:

- This wallets will recoup stolen assets

- Provides educational materials

- Supports more than 200 cryptocurrencies

Disadvantages:

- Ethereum staking is not available

- A bit pricey

Source: Exodus.com

The Exodus crypto wallet is widely well-known among crypto users. It supports over 200 cryptocurrencies and provides excellent educational materials and tutorial videos for beginners.

Users can trade and stake cryptocurrency directly from the Exodus wallet with its built-in exchange, which functions as a DEX. The benefit of a DEX is that it allows crypto trading through decentralized apps and may not require many credentials for signing in.

If you’re looking for offline storage, the Exodus wallet is integrated with Trezor, a highly-ranked cold storage option.

And two more extra options in our list are Hi and Nexo wallets:

Hi.com Wallet

Hi.com wallets can earn an interest of up to 40% per year for some cryptocurrencies. The wallet offers 11% on USDT and 5% on Ethereum. But you don't have to lock your funds. The wallet also provides flexible terms for investors who deposit funds on their platform.

Nexo Wallet

And the last wallet on the list is Nexo. It provides interest in crypto, stablecoins, and other standard currencies like the USD and EUR. The wallet is on our list because of its high-interest rates, which range from 8% to 16% APY.

On standard currencies like the USD and the EUR, Nexo pays a 12% APY, and the typical bank system can not offer such a juicy offer. Like other wallets, Nexo has its coin, which can earn you an extra 2% on top of the average interest rate.

Source: Nexo.io

How Does Crypto Interest Work?

Let's explore the four simple steps to begin earning interest:

- Open A Crypto Account

First, you need to make a platform that allows you to earn some interest and open an account there. If you already have an account, check if your platform allows its users to generate some income.

For example, BlockFi is a good option if you're a beginner in cryptocurrency. You can connect your BlockFi account with your bank account to purchase crypto with cash. The platform currently offers an 8.6% annual interest rate compounded monthly, depending on which cryptocurrency you use.

- Rates Comparison

Your next step is to compare the interest rates of different platforms.

It all depends if the company takes a cut of the interest or not. Thus, your interest rate may vary significantly, even if you invest in the same cryptocurrency.

What to consider a reasonable interest rate? Well, usually, it is between 6% to 9% for stablecoins. Some platforms offer interest rates over 100%. But this is where you should be careful, as such high rates are indicators of high volatility and risk. So, be skeptical.

- Add Coins To Your Portfolio

If you make an account with a platform that only accepts deposits in cryptocurrency, you'll need to create an account with a crypto exchange. Many crypto investors choose cryptocurrency exchanges such as Coinbase, eToro, or Binance. When you buy crypto through one of these exchanges, you can send it to your crypto wallet address on the chosen platform.

- Earn Interest

You'll earn interest once you have added funds to your interest account. Just watch your savings grow.

Crypto Savings Accounts Vs. Crypto Wallets

We need to clarify one important thing: a crypto savings account and a crypto wallet are different. They may sound alike, but the difference is the ability to earn interest.

When you keep your money in a cryptocurrency savings account, it will generate interest in the future. When you keep your coins in a wallet with keys that only you have, your investment will not earn interest. It means that the number of coins in your wallet will remain the same if you don't withdraw them.

But the brilliant news is that thanks to technology, some wallets let you earn interest in cryptocurrencies. So you can both store your coins and earn some interest.

Quick coin access is why many investors prefer wallets over saving accounts. They want to have complete control over their money. But if you invest using a cryptocurrency savings account, you give the account provider permission to loan out your initial investment. The account provider might limit when you can withdraw your coins. If you need quick access to your cryptocurrency investment, keep your crypto in a wallet then.

Conclusion

A cryptocurrency savings account can be a great appeal and bring you attractive returns if your investments are long-term. But remember, that the cryptocurrency market is highly volatile and doesn't have the same financial protections as banking institutions.