Why DEX Screeners Are the Backbone of DeFi

Decentralized finance (DeFi) is no longer a niche playground for crypto enthusiasts. By mid-2025, the total value locked (TVL) across DeFi protocols exceeded $65 billion, according to DeFiLlama. Millions of traders around the globe are turning to decentralized exchanges (DEXs) for transparency, accessibility, and the chance to uncover hidden gems before they go mainstream.

But here’s the challenge: DEX markets move fast. Tokens launch daily, liquidity shifts within minutes, and prices can spike or crash before you even refresh the chart. That’s where DEX screener tools come in.

A good coin screener or DEX scanner helps you track real-time prices, monitor liquidity pools, compare trading pairs, and analyze tokens across multiple blockchains. Without these tools, you’re trading blind. With them, you gain a real edge.

If you’ve ever asked yourself:

- What is Dexscreener, and why is everyone in DeFi using it?

- Is there a Dextools alternative that gives more accurate data?

- Which platform offers the best DEX charts for analyzing tokens before I ape in?

Then you’re in the right place. In this guide, we’ll explore the 10 best DEX tools every trader should know about, compare Dexscreener vs Dextools, and even highlight some underrated platforms that might become your new favorites.

Why Do You Need a DEX Screener?

Let’s be real for a moment. I remember the first time I tried to buy a low-cap altcoin on PancakeSwap back in 2021. The Telegram group was buzzing, “This coin is going 100x!” I rushed to trade, only to realize the chart on the exchange was almost useless. No liquidity details, no price history, no way to see if I was about to buy the top.

That mistake cost me money — and it could have been avoided if I had used a proper DEX analyzer.

A good DEX screener app allows you to:

- Track tokens across multiple blockchains

- Access real-time price data and liquidity metrics

- Spot rug pulls and scams faster

- Use DEX charts with technical indicators

- Compare pairs on different exchanges with a DEX aggregator list

The bottom line? Whether you’re chasing the most popular DEX coins or hunting hidden microcaps, you need the right tool.

The Top 10 DEX Screener Tools for 2025

Let’s dive into the platforms that are shaping the DeFi trading landscape.

1. Dexscreener

If you’ve been in DeFi for even a week, you’ve probably heard of Dexscreener. It’s one of the most popular DEX tools out there — and for good reason.

Company Profile

- Founded: 2021

- Location: Remote, global team

- Employees: 20+

- Industries served: DeFi, crypto traders, blockchain analytics

- Key services: Real-time charts, multi-chain token tracking, alerts

Features That Matter

- Multi-chain coverage: From Ethereum to Solana to BNB Chain, you can scan pairs across dozens of blockchains.

- Advanced DEX charts: Full candlestick analysis, RSI, MACD, Bollinger Bands.

- Real-time alerts: Get notified when a coin crosses a certain price or liquidity threshold.

- Smart contract lookup: Helps identify scams before you buy.

Why Choose Dexscreener?

- Easy-to-use interface — even for beginners.

- Free to use with optional pro features.

- Trusted by millions (seriously, their website gets more than 10 million monthly visits).

Example Use Case

Imagine you’re tracking a new token launch on Arbitrum. Within seconds, Dexscreener shows liquidity inflows, live price movement, and how it stacks up against similar coins. That real-time insight helps you decide whether to enter early or avoid a rug pull.

👉 If you’re not already using Dexscreener, try it today. It’s like trading with night vision goggles in the dark forest of DeFi.

2. Dextools

Before Dexscreener became a household name, there was Dextools. Launched in 2020, Dextools has been the go-to platform for Ethereum and BSC traders for years.

Company Profile

- Founded: 2020

- Location: Spain

- Employees: 15+

- Key services: Pair explorer, DEX charts, token scoring, whale tracking

Standout Features

- DEXT Score: An algorithmic score that rates tokens based on liquidity, volume, and holder distribution.

- Whale alerts: Track large trades in real-time.

- Portfolio tracking: Connect your wallet and monitor your holdings directly.

Why Choose Dextools?

- Pioneer in DEX analytics — one of the first serious DEX screeners.

- Strong Ethereum focus, great for ERC-20 token traders.

- Offers premium subscriptions with additional insights.

Dextools vs Dexscreener

This debate has been going on in the community for years. While Dextools is known for its DEXT Score and historical depth, Dexscreener often wins with its faster UI and broader chain coverage.

👉 Not sure which side you’re on in the Dextools vs Dexscreener debate? Try both and see which fits your trading style better.

3. TokenSniffer

Not all DEX tools focus purely on charts. Some, like TokenSniffer, specialize in detecting scams and rug pulls before it’s too late.

Company Profile

- Founded: 2020

- Location: USA

- Employees: ~10

- Industries served: Retail crypto investors, compliance, DeFi security

- Key services: Smart contract audits, scam detection, token risk ratings

Features

- Automated contract scanner: Rates tokens from 0 to 100 based on risk.

- Blacklist integration: Highlights tokens linked to known scams.

- Community reports: Traders can share findings on suspicious projects.

Why It’s Useful

If you’ve been in crypto long enough, you know rug pulls are everywhere. TokenSniffer acts as your early-warning radar.

Example Scenario

You find a hyped coin on a Telegram shill channel. Before aping in, you plug the contract into TokenSniffer. The score comes back 10/100 — meaning the contract is likely a copy of a scam. You just saved yourself hundreds of dollars.

👉Before you buy a coin, sniff it. TokenSniffer might just save your portfolio.

4. Uniswap Info

Sometimes the best DEX analyzer is the one built right into the exchange itself. Uniswap Info provides direct analytics for one of the top DEX platforms in the world.

Company Profile

- Founded: 2018 (Uniswap Labs)

- Location: New York, USA

- Employees: 100+

- Industries served: DeFi, crypto trading, blockchain infrastructure

- Key services: On-chain analytics for Uniswap pairs, liquidity data

What It Offers

- Real-time Uniswap data: Prices, volumes, liquidity pools.

- DEX charts integrated with the exchange: Seamless for active traders.

- Transparency: Data is pulled directly from the Ethereum blockchain.

Why Choose Uniswap Info?

If you’re trading ERC-20 tokens, there’s no better place to see raw liquidity and pair details. It doesn’t try to cover every chain — it just does Ethereum very well.

👉 Trading on Uniswap? Bookmark Uniswap Info. It’s the simplest way to stay informed without leaving the DEX.

5. 1inch — The Best DEX Aggregator

When it comes to DEX trading, finding the best price across multiple platforms can be tough. That’s where 1inch shines. It’s widely recognized as the best DEX aggregator in the market.

Company Profile

- Founded: 2019

- Location: Cayman Islands, with global contributors

- Employees: 120+

- Industries served: DeFi, cross-chain trading

- Key services: Trade aggregation, liquidity optimization, wallet

Features

- DEX aggregator list coverage: Pulls data from 300+ liquidity sources.

- Smart routing: Finds the most efficient trading path to minimize slippage.

- Multi-chain support: Works across Ethereum, BNB Chain, Polygon, Arbitrum, and more.

- Built-in wallet: Secure storage plus trading.

Why Choose 1inch?

- Often gives you better execution prices than trading directly on a DEX.

- Trusted by millions with billions in trading volume.

- Advanced features like limit orders and gas fee optimizers.

Example Case Study

A trader swaps $10,000 worth of ETH for USDC. On Uniswap, the slippage would cost ~$50. Through 1inch, the aggregator routes the trade across 3 liquidity pools, reducing slippage to just $10. Over time, that difference adds up.

👉 Want the edge in every trade? Add 1inch to your trading stack and stop leaving money on the table.

6. Matcha — A Simpler DEX Aggregator

Not every trader wants advanced dashboards or complex metrics. Matcha, built by 0x, offers a clean, user-friendly DEX aggregator that focuses on simplicity.

Company Profile

- Founded: 2020

- Location: San Francisco, USA

- Employees: 80+ (under 0x Labs)

- Industries served: Retail crypto traders

- Key services: Simple trade execution, price aggregation, token discovery

Key Features

- Intuitive interface: Looks and feels like a CEX, but powered by DEX liquidity.

- Price comparison: Automatically finds the best available rate.

- Watchlists: Track favorite coins without leaving the dashboard.

Why Choose Matcha?

- Great for beginners entering the DeFi world.

- Reliable DEX tool crypto app for making quick swaps.

- Transparent fee structure.

👉 If 1inch feels too advanced, Matcha is your friendly entry point to the DEX aggregator universe.

7. Poocoin — Not Just Memes

The name might make you laugh, but Poocoin has been a serious DEX scanner for BNB Chain traders since the DeFi summer of 2021.

Company Profile

- Founded: 2021

- Location: Remote

- Employees: <15

- Industries served: DeFi retail traders, memecoin hunters

- Key services: Real-time charts, wallet tracking, token discovery

Features

- BNB Chain focus: Tracks nearly every coin launched on PancakeSwap.

- DEX charts for microcaps: Essential for spotting early entries.

- Wallet tracker: See what top wallets are buying and selling.

Why Choose Poocoin?

- If you’re active in BNB Chain, there’s almost no alternative.

- Provides data that bigger platforms sometimes overlook.

- Affordable premium options for deeper analysis.

Example Use Case

A new memecoin launches with hype on Twitter. Before buying, you pull up Poocoin charts and see liquidity is only $2,000 with one wallet holding 40% of supply. That’s a red flag, and you avoid a likely rug.

👉 Don’t let the funny name fool you. Poocoin can save you from some very unfunny losses.

8. DexTools Alternative — Bitquery

For traders looking for a Dextools alternative that goes beyond charts, Bitquery is a powerful solution. It’s not just a DEX tool; it’s a full-blown crypto data analytics platform.

Company Profile

- Founded: 2018

- Location: Singapore

- Employees: 50+

- Industries served: Institutional traders, DeFi analysts, blockchain research

- Key services: On-chain data analytics, DEX scanner, historical trading data, APIs

Features

- DEX analyzer: Explore liquidity, volume, and token movements across chains.

- Data-rich charts: More than just price — track holder distributions, token flows, and smart contract activity.

- APIs for automation: Useful if you’re building a trading bot or monitoring multiple DEXs.

Why Choose Bitquery?

- Ideal for advanced traders and analysts.

- Goes beyond typical coin screener apps with detailed blockchain insights.

- Excellent for research-heavy trading strategies.

Example Scenario

An institutional trader wants to identify emerging tokens with low liquidity risk. Using Bitquery, they analyze holder distribution and recent inflows across Ethereum and BNB Chain before committing capital.

👉 If you need more than charts, explore Bitquery for a deeper understanding of the DeFi market.

9. CoinGecko — Beyond Market Cap

Many people know CoinGecko as a crypto market tracker, but it also functions as a DEX aggregator and screener.

Company Profile

- Founded: 2014

- Location: Singapore

- Employees: 150+

- Industries served: Retail crypto investors, DeFi traders

- Key services: Token rankings, DEX data, portfolio tracking, DeFi analytics

Features

- DEX aggregator list: Compare liquidity and prices across multiple exchanges.

- Top DEX tokens: Easily see the most popular DEX coins at a glance.

- Portfolio integration: Track holdings across DEXs and wallets.

Why Choose CoinGecko?

- Reliable, user-friendly, and one of the most trusted sources in the crypto space.

- Free with optional pro tier for advanced data.

- Offers both DEX charts and broader market analytics.

Example Use Case

A retail trader wants to diversify across several small-cap DeFi tokens. CoinGecko shows liquidity pools, price trends, and aggregated trading volume — all in one dashboard.

👉 CoinGecko isn’t just a coin tracker — use it to find hidden gems across DEXs too.

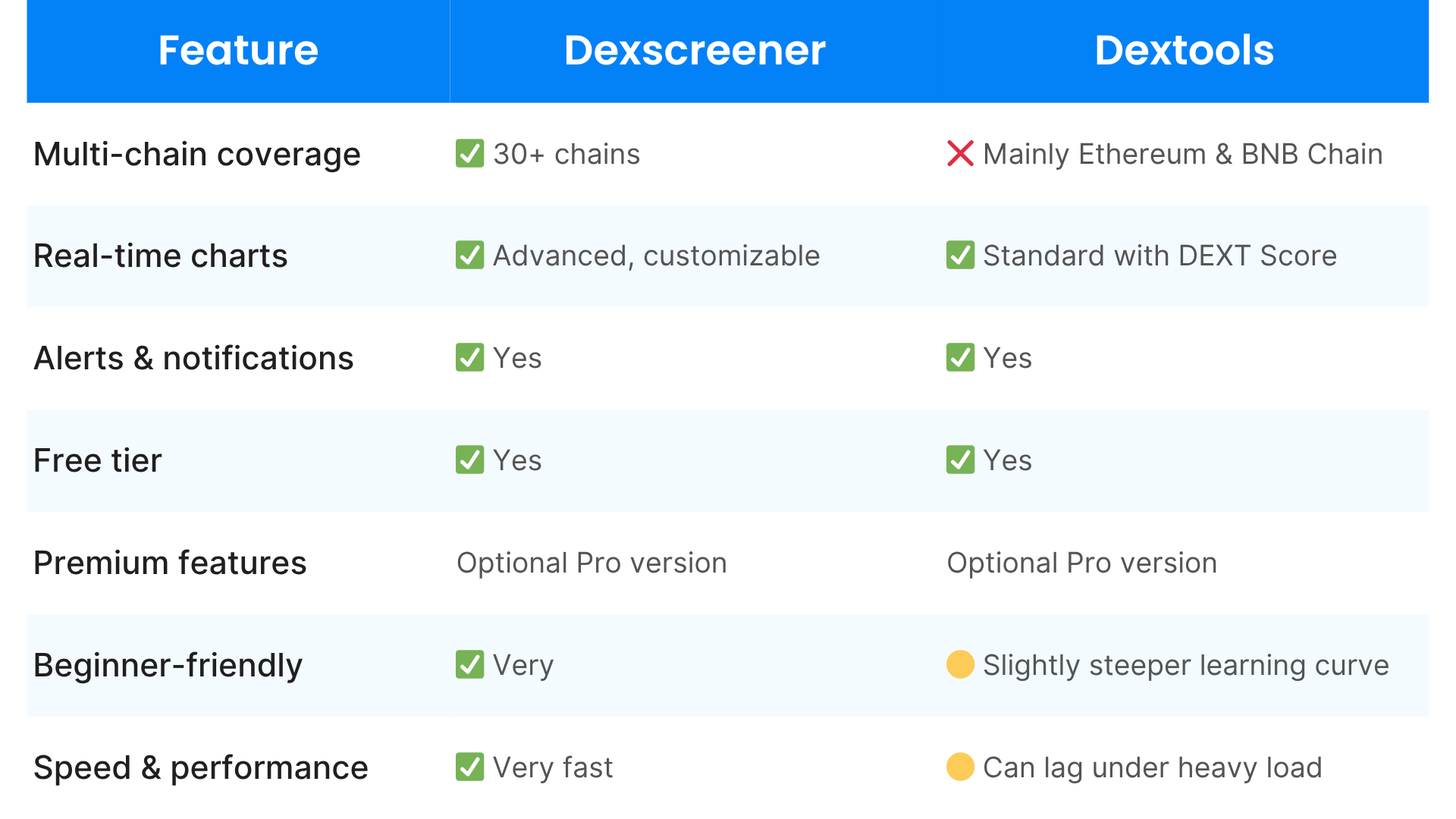

10. DexTools vs Dexscreener — The Ultimate Comparison

For traders torn between the two most popular DEX screeners, here’s a side-by-side look:

Bottom line: Dexscreener is best for traders needing multi-chain coverage and speed, while Dextools is ideal if you prioritize historical depth and DEXT scoring.

Honorable Mentions

While the top 10 are our focus, these platforms are also worth checking out:

- PooCoin Charts: Microcap and meme coin analytics on BNB Chain

- Matcha: Simple interface for quick swaps and price aggregation

- Zerion: DeFi portfolio management plus analytics

How to Choose the Right DEX Screener

When selecting a DEX tool crypto app, consider:

- Chains supported — Are you trading across Ethereum, BNB Chain, Polygon, etc.?

- Depth of analytics — Do you want just prices, or detailed token flow, holder distribution, and liquidity tracking?

- Ease of use — Beginners benefit from clean UIs like Matcha or CoinGecko.

- Alerts & notifications — Vital for fast-moving DeFi markets.

- Cost — Many tools offer free tiers; premium subscriptions add features like real-time alerts, lower latency, and APIs.

Conclusion — Master DeFi Trading With the Right Tools

The DeFi market is vast and volatile. Without a proper DEX scanner, you’re trading blind, risking missed opportunities or worse — losses from scams and rug pulls.

From Dexscreener’s multi-chain prowess to Dextools’ historical depth, and from 1inch’s smart routing to TokenSniffer’s scam detection, the right combination of tools can dramatically improve your trading strategy.

Pro Tip: Don’t rely on a single tool. Many successful traders combine multiple coin screeners and DEX aggregators to gain a complete market view.

By integrating these tools, you can:

- Spot emerging tokens early

- Minimize slippage and maximize profits

- Avoid common scams and rug pulls

- Analyze liquidity, volume, and token distribution with confidence

Whether you’re a beginner or an experienced trader, these platforms empower you to navigate the DeFi landscape like a pro.

👉 Start exploring these DEX screeners today. Combine them with AADS banner ads to promote your crypto projects with maximum reach and impact.

Sources

- Dexscreener official site — https://dexscreener.com

- Dextools official site — https://www.dextools.io

- TokenSniffer — https://tokensniffer.com

- Uniswap Info — https://info.uniswap.org

- 1inch Network — https://1inch.com/

- Matcha by 0x — https://matcha.xyz

- Poocoin — https://poocoin.app

- Bitquery — https://bitquery.io

- CoinGecko — https://www.coingecko.com

- DeFiLlama — https://defillama.com