Decentralized Finance, or DeFi, is a huge niche with a market cap value of approximately $75 billion and thousands of coins trading in the sector. DeFi became highly successful due to its blockchain-based protocol, which aims to eliminate third parties, such as banks and financial institutions, from all financial transactions. With the market growth, the number of DeFi tokens skyrocketed and is considered the next big thing in the crypto world.

In this article, we will look at some of the most promising coins on the market and the steps you need to take to buy them.

Most of the DeFi coins are expected to increase significantly in value. That's why many investors actively seek opportunities and hurry up to buy the best DeFi coins at the current dip. Plus, the historical rate of return for DeFi investments has been around 5-20%. These facts make DeFi so appealing to crypto investors.

What are DeFi Tokens

Crypto projects can offer enormous yields, sometimes hundreds and thousands %. But no one is sure that investors will not lose all their money within a second. The purpose of DeFi is to decrease the risks and find the balance between volatility and return. That's where DeFi helps to eliminate the risk of losing everything at once.

DeFi tokens, in turn, are a set of cryptocurrencies native to automated, decentralized platforms that operate using smart contracts. As DeFi, in general, such tokens aim to transform banks, exchanges, and other traditional financial systems by using cryptocurrencies by eliminating the need for intermediaries.

Most of the DeFi tokens run on the Ethereum blockchain. Users can trade, get loans, earn interest, and more. But remember that despite its hype and outstanding yields, DeFi tokens are considered high-risk investments with high volatility.

How to Buy DeFi Tokens

First, when choosing the best DeFi projects, you should analyze the top DeFi crypto based on long-term growth, market capitalization, current coin price, and available exchanges.

Now let's see how to buy your first DeFi tokens:

Step 1: Choose a wallet

When choosing a wallet, think about such factors as accessibility and compatibility. For example, hot wallets, which are software-based, are easy to use and have high accessibility. But some people consider them less secure. At the same time, cold wallets are hardware wallets. They are a separate mechanism designed to protect crypto assets from cyber attacks. They are often expensive and less convenient to use.

Most big crypto exchanges like Coinbase or Binance offer their wallets. They are available as a mobile app and browser extension.

We have written a useful guide on how to choose a crypto wallet here.

Step 2: Choose a Wallet username

When setting up your wallet, you will need to choose a username. This username lets other wallet users easily send you crypto. You keep it, and you will need it to access the account.

Step 3: Keep your recovery phrase in secret

When creating a new self-custody wallet, you'll receive a recovery phrase. This phrase consists of 12 random words you need to remember or copy somewhere safe. As the recovery phrase is the key to your crypto, anyone with it has access to your wallet. And never on Earth tell your recovery phrase to anyone. Remember the stories when people lost billions because they forgot their passwords? An exchange cannot help you access your wallet if you lose your recovery phase.

Step 4: Purchase Crypto Coins

Now you need crypto coins to participate in DeFi protocols. Most popular wallets can be connected to exchanges where you can purchase DeFi coins. Obtain a DeFi token by visiting the protocol's website and linking your wallet to buy native coins. Then you can invest in the pool of your choice on the platform. And remember to check the fees you will charge before buying any coins.

Step 5: Get Started With Protocols

All the major protocols are based on Ethereum, meaning that you can lend or borrow any ERC20 token. The Protocols make it possible for investors to trade or stake (or lock up) crypto for a reward. You can also participate in liquidity pools to receive earnings as a reward when transactions are made in your collections. Plus, you can be engaged in yield farming, giving someone a loan and earning some interest for it.

In a nutshell, when dealing with protocols, you need to visit that protocol's website or app, connect your wallet so that their platform can access your crypto coins, and follow their instructions to start trading, yield farming, or whatever you want.

Step 6: Track Your DeFi Investments

And the final step is to track your investments.

Best Defi Tokens to Buy

Choosing the best DeFi tokens is complicated, as plenty of them are released nearly daily. When selecting one, carefully check the token's utilities, fees, current market capitalization, objectives and road map targets, and ease of use.

Below, there is the list of the best DeFi tokens for you to choose from:

Source: Luckyblock.com

This is one of the best DeFi tokens to buy, and let's see why. The Lucky Block project, launched in 2021, uses blockchain protocols that provide a play-to-earn and prize draw platform. The token is supported on Pancakeswap, which is one of the largest Decentralized exchanges (DEXs) in the DeFi sector. After the ICO of $0.00089, LBLOCK skyrocketed to $0.009617, which gave its users more than a 10x price increase, and the coin became one of the best-performing digital assets of the year.

At the center of the ecosystem is LBLOCK, which is a native digital token. If you hold LBLOCK tokens, you can buy tickets and not pay any transaction fee. The users receive quick payouts on daily jackpot rewards.

Lucky Block is trading at only $0.0001382 per token and has excellent potential to grow.

Source: Aave.com

Aave is one of the oldest DeFi platforms, created in 2017. It was the first crypto lending platform to support non-collateralized crypto loans. The platform's popularity was rising with interest in AAVE, especially after the tokens rallied by 3000%+ in early 2021.

Even though the price of Aave has fallen by 69.83% in the last year, this DeFi coin has a promising future for several reasons.

First, Aave has the third-largest total value locked – more than $1 billion – and is a multi-chain protocol. It has already deployed on such a large blockchain as Fantom and is expected to launch more in the future.

A revived DeFi craze and AAVE's resilience are expected to help catapult the token prices to inconceivable heights by the turn of the decade. Optimistic investors are confident that AAVE token prices could rally by more than 6000% to top $3500 – yet another confirmation that Aave is the best DeFi crypto to buy in the current dip.

Source:Uniswap.org

Uniswap is a popular Ethereum-based decentralized exchange with its governance token. It has attracted over 3 million users and has processed trades worth more than $1 Trillion in the last three years. It is also one of the most valuable DeFi protocols, with a market cap of $4,9 Billion and more than $7 Billion in total value locked.

What makes Uniswap so unique? First, it is an entirely different type of exchange that's fully decentralized. It means it isn't owned and operated by a single entity and uses a relatively new trading model called an automated liquidity protocol.

Secondly, Uniswap is open source, which means anyone can copy the code to create decentralized exchanges. It even allows users to list tokens in exchange for free.

Uniswap's token is a governance token, meaning holders can vote on new developments and changes to the platform. They also can choose how minted tokens should be distributed to the community and developers, as well as any changes to fee structures.

While UNI has corrected from a price-high of $43 to only $6.49, it has the backing of a robust ecosystem that provides easy liquidity to facilitate Peer-to-Peer transactions in an utterly decentralized manner.

Source:Cosmos.network

Cosmos is a unique project with a market cap of around $2.5 billion.

The Cosmos network tries to solve the blockchain interoperability problem - a process allowing multiple blockchains to interact with each other. Cosmos has a protocol that helps compete for blockchains to communicate with each other. This would enable Bitcoin, for example, to share and extract data from the Ethereum blockchain – and vice versa.

This outstanding solution made ATOM the 30th largest cryptocurrency on the market. It's currently trading at $12.79, which is approximately a 46% ROI from the time of the initial token release.

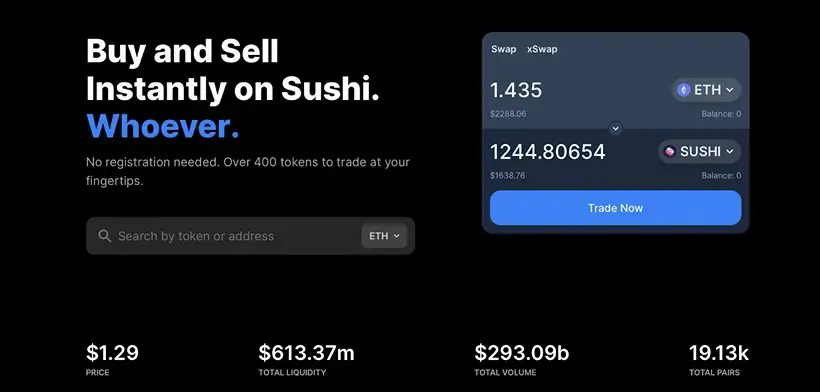

Source: Sushi.com

Despite the not-so-attractive title, SushiSwap is a popular decentralized exchange that provides high levels of liquidity to users. SUSHI's market cap is around $287 million, offering high levels of liquidity to users.

SushiSwap is an automated market maker (AMM) that creates an automatic algorithm to provide liquidity between multiple DeFi tokens in an utterly decentralized manner. It is also built on the Ethereum chain, and users can trade ERC-20 tokens on SushiSwap through liquidity pools. SushiSwap also provides interest-earning options on its NFT marketplaces and yield farming.

You also don't need an account to use SushiSwap, and being a governance token, SushiSwap gives its holders voting rights. If you buy SushiSwap, you can vote on proposals and help determine what happens with it.

DeFi Coin is in our list as it has been named one of the best-performing digital currencies last year. What makes it so unique? DeFi Coin is a cryptocurrency token firmly ingrained within the ever-growing decentralized finance (DeFi) sector. Being a native token of the Defi Swap exchange, this coin gives its users plenty of opportunities to swap and stake various DeFi tokens easily. You must connect your wallet to the DeFi Swap platform and choose which two tokens you want to convert. All transactions are secured.

You can earn rewards in DEFC tokens through a "static rewards" process. In a nutshell, it means that when a user sells or swaps their Defi Coin holdings, a 10% tax is held from this transaction. Then, 50% of this tax is distributed proportionately among the current token holders. That's not all. Later, 50% is redistributed into the liquidity pools of Defi Swap. This redistribution helps to prevent volatility.

DeFi Swap plans to develop its ecosystem and take care of new investors by creating educational tutorials and materials for further usage.

One more coin on our list is Yearn. Finance. It is a popular and revolutionary cryptocurrency with a great history. It has sustained an overall positive ROI since its launch – having peaked more than 10000% above its introductory price during the early 2021 market rally. Moreover, it has one of the lowest maximum token supplies – capped at 36,666 YFI – which, based on its growing popularity, will help keep its token prices uptrend.

Yearn. Finance has competitive interest rates allowing investors to earn passive income when they stake their coins on the platform. Plus, most analysts in the crypto market say that they expect YFI token prices to top $400,000 by the turn of the decade, which would mean close to 7000% value gains for you if you buy the token today.

What’s more?

Some other great DiFi coins to buy are FightOut, with its exclusive Move-to-Earn fitness app, Dash 2 Trade, which leverages blockchain technology and decentralized finance into trading signals, IMPT, Tamadoge, The Graph, and Battle Infinity. All these coins have great potential for exponential growth moving forward.

Conclusion

We have mentioned only several promising DeFi coins, while new coins appear on the market every week. So observe, research, and wish you luck finding your most profitable coin!