When running your own online business or a project, you need to accept credit card payments on your website. That's when you need a payment gateway. You use it regularly as a client. But if you want to know more about how this technology works for crypto payments, this article explores the ins and outs of payment gateways and how to get one set up for your business.

What Is A Payment Gateway And How Does It Work?

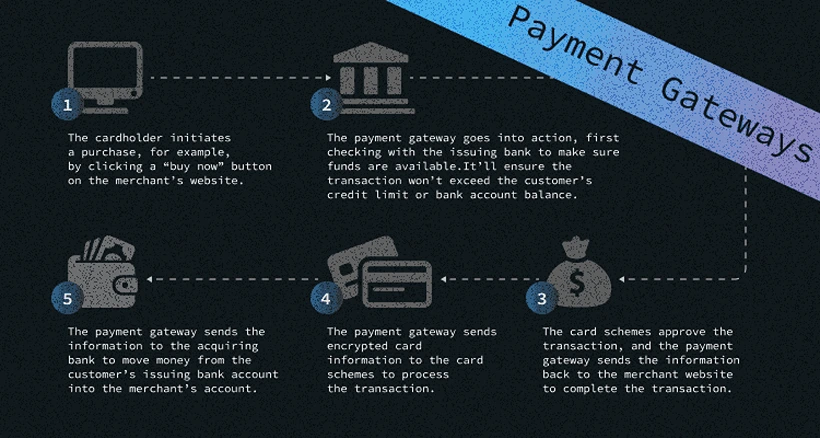

First, let's get to the basics of the gateway payment mechanism. In a nutshell, this is the mechanism that reads and transfers payment information from a customer to a merchant's bank account. It captures the data, ensures that funds are available, and then pays the merchant.

Online payment works the same. The main difference is that a payment gateway is cloud-based software that connects the seller and the customer. When you pay in an offline shop, this software is built into a point-of-sale (POS) system or card reader that processes a transaction when the cardholder pays by card. The payment process includes stakeholders such as a seller, customer (a cardholder), issuing bank, credit card companies that manage the card (like Visa and Mastercard), and an acquiring bank that holds the merchant's account.

Let's look at the graph that helps to understand the process better:

Why Customers Want To Pay With Crypto

I want to show you some exciting statistics first. According to the PYMNTS survey conducted in May, almost one-third (30%) of crypto owners said they had bought something online using their digital assets. While more than one-fifth (21%) of holders made an in-store purchase using crypto. At the same time, one-quarter of crypto owners said they would choose sellers that accept crypto.

And not only have customers experienced the convenience of crypto payments, but such red-taped organisations like banks also see crypto payments' potential. Thus, Visa has more than 30 crypto card programs, and Mastercard has more than 20.

Reason 1 - Better Security

Cryptocurrency is considered more secure than credit and debit card payments, especially after the pandemic when credit and debit cards were the sources of the majority of fraud reports among all payment methods. Plus, the blockchain general ledger verifies and records every transaction, making it nearly impossible to steal someone's identity. Crypto, in turn, does not need third-party verification, and when a customer pays with cryptocurrency, their data isn't stored in a centralised hub. And these hubs are very often a source of breaches.

Reason 2 - Irreversibility

Cryptocurrency transactions are irreversible, which helps business owners better manage their cash flow. But, if someone requires a refund, the retailer must manually pay them back.

Reason 3 - Low Fees

Probably, the most popular reason is the fee. Just compare PayPal charges around 4% per transaction, which is a rip-off. At the same time, Cryptocurrencies charge much lower fees, if any. Plus, if your business works worldwide, cryptocurrencies can help avoid international currency payment fees, which is incredible.

Best Bitcoin Gateways Of This Year

If you want a payment gateway for your business, it's wise to choose a highly secure and beneficial platform and pick up the best one. So, which is the best?

1. BitPay

Let's start with BitPay. This is an easy and simple payment gateway to set up and operate. The whole process has been created to make it as straightforward as possible to concentrate more on business than tech innovations.

BitPay has two useful features for sellers. Firstly, you can set withdrawal transaction speeds to a necessary time frame. This feature is handy if you prefer withdrawals to occur at set intervals. The second feature is the two-factor authentication that helps make accounts even more secure.

This bitcoin payment gateway offers a free cap of $1,000 worth of daily transactions and $10,000 in annual transactions. If more transactions are done, it levies a 1% transaction fee. The only disadvantage of this gateway is that it supports direct bank deposits only in 38 countries.

2. Coinbase

Coinbase is one of the largest cryptocurrency exchanges, but it also offers crypto payment gateway services through Coinbase Commerce. This gateway is fast and allows merchants to receive payments securely.

Coinbase works in 100 countries. Its payment methods are bank accounts, deposits, debit cards, credit cards, and PayPal. Impressive, right? Moreover, Coinbase offers some integrated services for Shopify, WooCommerce, Magento, and OpenCart. It works not only with Bitcoin but supports a variety of cryptocurrencies such as Ethereum, Bitcoin Cash, Litecoin, Dogecoin, USD Coin, and DAI.

The exchange offers such service for free on the first $1 million of transactions but after levies a merchant fee of 1%.

3. Coingate

Another good solution is Coingate. This gateway allows merchants to accept even traditional currency payments like USD and Euros. This gateway is super user-friendly and will enable merchants to set up and monitor payments from their phones, making the process convenient.

Coingate supports 40 other cryptocurrencies apart from Bitcoin and offers a range of various plugins. These plugins help users to create bitcoin payment buttons on any website.

As for the fees, Coingate charges around 1% on all transactions, which usually take about 1 hour.

4. CoinsBank

This user-friendly gateway has a beautiful reputation and apps for Android and iOS. This great bitcoin gateway supports most major fiat currencies, including USD, GBP, and EUR.

As for more bonuses, Coinsbank allows for the free transfer of currency to family and friends 24/7. Plus, the platform offers the latest security, including a two-factor authentication system and a 24-hour customer support system to help users to solve their problems instantly.

5. Shopify

Probably everyone has heard about this brand. Shopify is one of the world's most trusted and best cryptocurrency payment gateways. It is already used by 1,000's businesses worldwide to accept payments in bitcoin and other cryptocurrencies.

The platform is packed with heaps of good features, including APIs that allow integrations with Coinbase and other payment gateways that help make payment processing as easy and transparent as possible.

What about the drawbacks? Well, they occur as usual. Shopify wants merchants to use the payment processing facility to sign up for a Shopify merchant account. Transaction fees vary depending on which payment processor a merchant chooses.

6. AlfaCoins

The last on our list, but not the least important. AlfaCoins offers an opportunity to split payments between fiat and cryptocurrency. If merchants want to retain some bitcoin from each transaction to cash in on surging prices, this is an excellent option, as it allows them to hedge their bets without taking a significant risk.

The transaction fee is also relatively low, at only 0.99%. But, AlfaCoins doesn't offer the $1 million worth of free transactions that Coinbase does. One more advantage is that AlfaCoins works worldwide, except for Iran and North Korea.

AlfaCoin supports major cryptocurrencies, including Bitcoin, Bitcoin Cash, Dash, Litecoin, Ethereum, Tether ERC-20, and XRP. You also can withdraw the funds in USD or Euro.

Pros And Cons Of Crypto Payment Gateways

I have mentioned the significant advantages of implementing crypto gateways for your business, such as security and low transaction fees. Now I also want to mention some drawbacks of using crypto gateways. They are:

- Again Irreversibility

Yes, business owners will better manage their cash flow with a crypto gateway. But, if someone requires a refund, the retailer must manually pay them back. If you have a ton of refunds during the holiday season, your team will need to divert time and attention toward returning payments individually. It forces your team to keep immaculate records and creates inefficiency in your business operations and lots of additional work for your employees.

- Tax

In many countries, cryptocurrency is tax regulated. So, if you accept cryptocurrency, you must report it as gross income based on its fair market value when it was received. That also means you should study the cryptocurrency tax regulations of your country thoroughly.

- This Method Is Still Risky

Governments still can't manipulate the value of cryptocurrencies, which is both a risk and a benefit. On the one hand, cryptocurrencies are a hedge against monetary inflation. But the value of popular crypto is exceptionally volatile, and for many business owners, that risk level makes cryptocurrency unattractive.

Conclusion

It's always great to have a choice. Even if now using a cryptocurrency payment gateway isn't a must-have, you can still consider this solution's pros and cons. Check out the characteristics of top cryptocurrency payment gateways to know which one suits your business best.

More About Crypto Marketing:

Influencer Marketing For Crypto Projects

Avoiding Common Mistakes: Why Your Telegram Ads May Be Denied

10 Powerful Growth Marketing Strategies for Your Business

10 Tips for Better Mobile Optimization in Crypto Advertising

Crypto ICO Marketing: Strategies for Success in the Crypto World

Content marketing for crypto projects

How Podcasts Can Help Your Business Grow

How To Create A Perfect LinkedIn Page For Your Business

Successful Email Marketing For Crypto Projects.

What is a crypto Press Release and how to write it?

Seo Strategies For Your Crypto Business

FAQ

1. What is a payment gateway?

A payment gateway is a cloud-based software that facilitates the transfer of payment information from a customer to a merchant's bank account. It captures and verifies payment data before transferring funds to the merchant.

2. How does a payment gateway work for online transactions?

In online transactions, a payment gateway connects the seller and the customer. It handles the interaction between the customer, the merchant, the issuing bank, credit card companies, and the acquiring bank. It ensures the security and validity of the payment process.

*3. Why are crypto payments becoming popular among customers? Customers are attracted to crypto payments due to their convenience and security. Statistics show that many crypto owners have made online and in-store purchases using digital assets. Crypto payments are seen as more secure and offer benefits like irreversible transactions and lower fees.*

4. What are the advantages of using crypto payments?

Crypto payments offer better security due to blockchain verification, irreversibility of transactions, and lower transaction fees compared to traditional payment methods.

5. What are some well-known crypto payment gateways?

Several popular crypto payment gateways include BitPay, Coinbase Commerce, Coingate, CoinsBank, Shopify, and AlfaCoins. These gateways offer various features and benefits for businesses to accept crypto payments.

6. How secure are crypto payment gateways?

Crypto payment gateways utilize advanced security measures, including blockchain verification and two-factor authentication, to ensure transaction safety and protect merchants and customers.

7. What are the drawbacks of using crypto payment gateways?

One drawback is the irreversibility of transactions, which can complicate refund processes. Additionally, crypto payments may be subject to tax regulations in some countries. The volatile nature of cryptocurrency values can also be a concern for businesses.

9. What should businesses consider when choosing a crypto payment gateway?

When selecting a crypto payment gateway, businesses should consider security features, supported cryptocurrencies, transaction fees, integration with other platforms, and whether it aligns with their business needs.

10. Are there any limitations to using crypto payment gateways?

While crypto payment gateways offer benefits, they also come with challenges, such as the need for businesses to manage refunds manually and potential issues related to cryptocurrency volatility.

References:

How to Integrate Cryptocurrency Payments on Your Website - Link: https://cointelegraph.com/learn/how-to-integrate-cryptocurrency-payments-on-your-website

Benefits and Risks of Cryptocurrency Payments for Businesses - Link: https://www.businessnewsdaily.com/13389-cryptocurrency-payments-for-business.html